If you have ever worked on a government-funded construction project in the U.S., chances are you’ve heard the term certified payroll reporting. But what does it really mean? And why is it so important for contractors and employers?

In this guide, I’ll break it all down for you.

We will cover what is certified payroll reporting, how it works, the legal requirements, penalties for mistakes, and even tools to make the whole process easier.

Let’s get started!

Simplify Global Payroll & Compliance

Automate payroll, handle taxes, and reduce risks with Remire’s trusted solutions for global teams.

What is Certified Payroll Reporting?

Certified payroll reporting means sending a special form that shows each worker’s hours, pay rates, deductions, and job type when working on public construction projects.

The employer has to sign this form to confirm that all the information is true and accurate. This helps the government check that workers are being paid fairly.

How Does Certified Payroll Work?

Each week on a public construction project, the contractor keeps track of every worker’s hours, pay, and job type.

They put all this information into a certified payroll report and send it to the government agency overseeing the project.

This report makes sure wage information is clear and helps stop workers from being paid less than they should.

The report includes:

- The names of workers on the project

- Their hourly pay rates

- Hours worked each day and total hours for the week

- Any deductions taken from their pay

- A confirmation that the wages meet legal requirements

This process helps contractors follow wage laws and stay responsible for paying their workers fairly.

Download a certified payroll example PDf

Who needs to file certified payroll?

Contractors and subcontractors working on public construction projects paid for fully or partly by federal or state funds must file certified payroll reports.

This covers projects like building schools, highways, or government buildings. Usually, if the contract includes rules from laws such as the Davis-Bacon Act, certified payroll is required.

Private companies working on non-government projects typically do not have to file certified payroll reports.

Who is exempt from certified payroll?

| Exempt Category | Details |

|---|---|

| Private Projects | Construction projects with no federal, state, or local government funding. |

| Small Contracts | Federal contracts under $2,000, or under the threshold set by state/local laws. |

| Suppliers & Material Vendors | Companies that only deliver materials and do not perform labor on-site. |

| Professional Services | Engineers, architects, surveyors, and consultants providing non-construction services. |

| Non-Labor Service Providers | Businesses renting equipment without operators or offering services unrelated to construction labor. |

What is the Davis-Bacon Act?

The Davis-Bacon Act is a federal law created in 1931. It says that contractors working on construction projects funded or supported by the federal government must pay their workers the “prevailing wages” and benefits that are common for similar jobs in the area.

This law was made to protect workers from being paid less than the usual local pay on public projects.

Contractors have to follow this law and prove they did by submitting certified payroll reports.

Recordkeeping Requirements for Certified Payroll

Employers need to keep certified payroll reports, timesheets, and pay slips for several years, usually three to five years.

These records must be ready to show to government inspectors or auditors to prove they followed the rules.

Keeping accurate and organized records helps avoid fines and makes it easier to handle any questions or audits later.

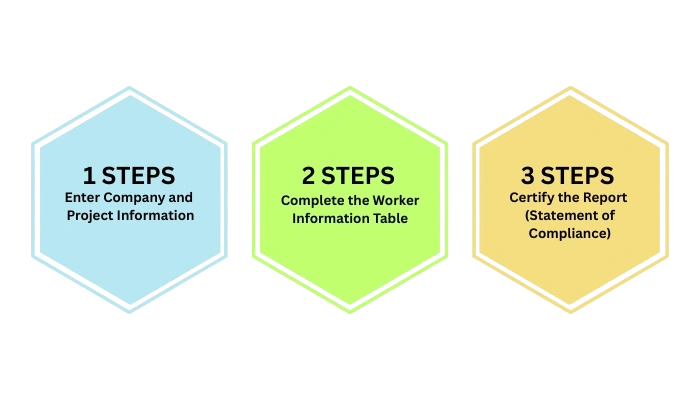

How to fill out a certified payroll report? Overview of Form WH-347

Form WH-347 is the most common certified payroll form used for federal projects under the Davis-Bacon Act. The form is simple but needs to be filled out carefully.

It gathers:

- Company and project information

- Employee work hours and wage details

- A final statement confirming the report follows the rules

Some states or local agencies may have their own forms or ask for extra information.

Step 1: Enter Company and Project Information

Start by clearly writing:

- Your company’s legal name and address

- The project name or number

- The week ending date for the pay period

- Any required contract or government agency details

Step 2: Complete the Worker Information Table

Here is what is included in a certified payroll report. For each employee, fill in:

- Full name and an ID number if you use one

- Job classification according to the contract (matching wage rules)

- Hours worked each day, including regular and overtime hours

- Total hours worked for the week

- Hourly wage rate for their classification

- Gross pay earned before deductions

- Itemized deductions like taxes, benefits, or union dues

- Net pay after deductions

This section must be accurate because mistakes can cause serious problems.

Step 3: Certify the Report (Statement of Compliance)

At the end of the form, a company official or payroll manager must sign and date to confirm that:

- The report is complete and truthful

- Wages follow the prevailing wage laws

- Records exist to support the report

Penalties for Non-Compliance with Certified Payroll

Not following certified payroll rules can lead to serious problems.

Common mistakes and violations include:

- Misclassifying employees by putting them in the wrong job categories to pay them less

- Paying workers less than the required wages or not providing required benefits

- Failing to keep accurate records like timesheets, pay stubs, or complete reports

- Missing weekly payroll report deadlines or not submitting reports on time

Penalties for breaking the rules can include:

- Fines and money penalties

- Withholding of payments on the contract

- Suspension or cancellation of contracts

- Legal action and damage to company’s reputation

Contractors must take these rules seriously to avoid costly penalties and legal troubles.

Tools and Software to Simplify Certified Payroll Reporting

Many contractors use certified payroll software or online platforms to make certified payroll easier. These tools help by:

- Automating data entry and calculations

- Making sure wage laws are followed

- Creating ready-to-submit certified payroll reports

- Keeping records organized for audits

- Allowing electronic submission directly to government agencies

Using these tools saves time, improves accuracy, and reduces the stress of managing certified payroll.

Working with a Provider for Certified Payroll

Some businesses hire outside payroll or HR providers who specialize in certified payroll. These experts handle:

- Weekly payroll calculations

- Preparing and filing certified payroll reports

- Keeping up-to-date with wage law changes

- Managing record retention and audit support

Outsourcing these tasks lets contractors focus more on running the project without worrying about payroll paperwork.

Best Practices for Managing Certified Payroll Reports

To manage certified payroll well:

- Keep detailed daily time records for every employee

- Double-check payroll details and job classifications before sending reports

- Use trusted, law-compliant payroll software or providers

- Stay updated on prevailing wage laws for your projects

- Submit certified payroll reports on time every week

- Keep organized backup documents in case of audits

Following these best practices lowers the chance of mistakes, fines, or delays. It also builds trust with government agencies and project owners.

Frequently Asked Questions (Faqs)

How do you do certified payroll?

Track each worker’s hours, pay rate, and deductions weekly, fill out Form WH-347 (or state form), sign the compliance statement, and submit the report to the agency or contractor. Keep records for at least 3 years.

What is a certified payroll professional?

A Certified Payroll Professional (CPP) is a payroll expert certified by the American Payroll Association, demonstrating advanced knowledge of payroll laws, compliance, and systems.

How can you simplify certified payroll?

Use certified payroll software or outsource to a payroll provider to automate calculations, ensure compliance, and generate ready-to-submit reports.

Does QuickBooks have certified payroll?

Yes. QuickBooks can handle certified payroll by integrating with add-ons or using its payroll features to generate WH-347 forms and compliance reports.

What is the best certificate for payroll?

The Certified Payroll Professional (CPP) is the most recognized credential. For beginners, the Fundamental Payroll Certification (FPC) is also valuable.

Wrapping Up

If you were confused about what is certified payroll and why it matters, this guide is a go-to guide for you. It is really all about making sure workers on government construction projects get paid fairly and on time.

By knowing the rules, staying organized, and using helpful payroll tools, you can handle certified payroll without stress.

Getting it right not only keeps your business out of trouble but also shows you are doing your part to support fair wages and honest work.

So, understanding certified payroll isn’t just paperwork; it’s a key part of running a smooth and trustworthy project.