Finding top-quality talent without setting up a full overseas entity is now a strategic advantage, especially for US-based companies that want to scale fast, access global skill-pools, and optimise cost.

If you are looking to hire contractors in Pakistan for US-based companies, this guide is your playbook. You will learn how to identify the right type of contractor relationship, handle payments and tax compliance, and onboard and manage your remote team in Pakistan.

We will also cover how to avoid common pitfalls when hiring internationally. By the end of this, you’ll be ready to engage contractors in Pakistan with confidence and clarity.

How to Hire Contractors in Pakistan for US-Based Companies through Remire?

Hiring remote talent in Pakistan can be simple if you use the right platform.

Remire.co helps US-based companies hire, pay, and manage independent contractors in Pakistan without the need to set up a local office.

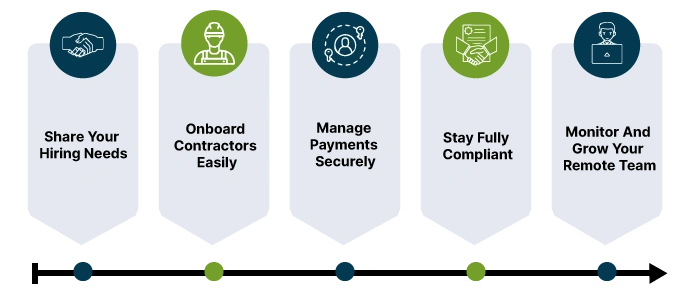

Here is how it works step-by-step

Step 1: Share Your Hiring Needs

Tell Remire what type of contractor you want to hire — developer, designer, marketer, or accountant.

We help you draft a compliant contractor agreement that fits Pakistan’s legal framework.

Step 2: Onboard Contractors Easily

Contractors can be onboarded within minutes, not weeks. Remire collects all required documents, including Form W-8BEN, NDAs, and service contracts, ensuring both parties are fully compliant.

Step 3: Manage Payments Securely

Pay your contractors in USD or PKR through bank transfer, Wise, or Payoneer — all from one dashboard. Remire automates currency conversion, invoicing, and payout tracking, so you never worry about delays or errors.

Step 4: Stay Fully Compliant

Remire ensures every contract and payment follows U.S. IRS and Pakistan FBR regulations.

You get built-in tools for tax reporting, payment receipts, and export-of-services documentation.

Step 5: Monitor and Grow Your Remote Team

Track performance, deadlines, and payments in a single platform. You can add new contractors anytime, without new paperwork or legal setup.

Why Should You Hire Contractors Through Remire?

- No need to open a Pakistani entity

- Pay globally, stay compliant locally

- Automated tax and legal paperwork

- Transparent pricing, no hidden fees

Remire makes it easy for US-based companies to hire contractors in Pakistan, fast, compliant, and stress-free.

Why Hire Contractors in Pakistan for US-Based Companies? 5 Key Reasons

Hiring contractors in Pakistan offers strong value for US businesses looking to grow global teams without high costs or compliance headaches.

1. Cost Efficiency

Labor costs in Pakistan are much lower than in the US, while skill levels remain high. You can access expert developers, designers, marketers, and finance professionals at competitive rates, helping reduce payroll expenses by up to 60%.

2. Skilled English-Speaking Talent

Pakistan has a large pool of educated professionals fluent in English and experienced with international clients. Communication and collaboration across time zones are smooth and reliable.

3. Flexible and Scalable Workforce

You can quickly hire or scale down contractors as your project needs change, without dealing with complex HR or long-term commitments.

4. Strong Work Ethic and Remote Culture

Pakistan’s IT and service sectors have adapted well to remote work. Most professionals are comfortable with global tools like Slack, Trello, and Zoom, ensuring efficient delivery.

5. Easy Cross-Border Payments

With platforms like Remire, Wise, and Payoneer, sending secure USD or PKR payments to contractors in Pakistan is fast, compliant, and affordable.

Contractor vs Employee for US-based companies hiring in Pakistan

| Feature | Independent Contractor in Pakistan | Full-Time Employee (Pakistan) |

|---|---|---|

| Contractual nature | Project-based, defined deliverables | Ongoing employment, work hours, and benefits |

| Benefits obligation | No statutory benefits from your US company | You may need to register with EOBI/Social Security |

| Tax withholding by a US company | Typically, none (contractor responsible) | May require withholding/registration |

| Scalability | Highly flexible – ramp up/down project basis | Less flexible, higher fixed cost |

| Compliance risk | Lower if correctly classified and contract structured | Higher obligations & risks of misclassification |

| Onboarding complexity | Simpler workflow, minimal local entity setup | May need local entity, payroll, and employment registration |

| Ideal for | Specific deliverables, short-to-medium term assignments | Long-term roles, integrated team members |

Risks of Misclassifying Pakistani Contractors?

Misclassification occurs when you treat a contractor as an employee.

Risks include:

- Backdated taxes and penalties

- Legal disputes over benefits or wrongful termination

- Blocked remittance approvals

Remire’s EOR model prevents this by ensuring correct classification and payroll compliance.

6 Best Practices to Hire Contractors in Pakistan

- Use a legally reviewed contract: Always start with a standard contract template reviewed by a lawyer who understands Pakistan’s labor and tax laws. It protects both your company and the contractor.

- Agree on payment terms early: Clearly define the payment currency (USD or PKR), method, and frequency before work begins to prevent confusion or delays.

- Start with a pilot project: Begin with a small test project to assess communication, quality of work, and reliability before committing long-term.

- Respect local culture and holidays: Plan around Ramadan, Eid, and national holidays in Pakistan to maintain good relationships and realistic deadlines.

- Keep proper records: Save all contracts, invoices, receipts, and payment proofs — these are essential for US tax filings and company audits.

- Use trusted global platforms: For faster scaling and compliance, use platforms like Remire, Deel, or Remote to handle onboarding, payments, and tax documentation securely

4 Common Challenges of Hiring Remote Contractors in Pakistan

While hiring contractors in Pakistan offers great value, it also comes with a few challenges that US companies should understand before scaling remote teams.

1. Legal and Compliance Differences

Pakistan does not have a separate legal definition for “independent contractor.”

This makes classification important — if you treat a contractor like an employee (fixed hours, control, benefits), it may create compliance risks.

2. Time Zone Coordination

Pakistan is roughly 9–10 hours ahead of US time zones, which can make real-time meetings tricky.

Using project management tools and setting overlapping working hours helps maintain communication.

3. Documentation and Tax Proof

Contractors must provide Form W-8BEN for US compliance and maintain FBR registration for their own taxes.

Missing paperwork or incomplete remittance proof can delay payments or audits.

4. Data Security and Communication

When working remotely, ensuring data confidentiality and IP protection is vital.

US companies should use NDAs and secure cloud tools to protect sensitive information.

How to Convert a Contractor into an Employee in Pakistan?

If a freelancer becomes a long-term part of your team:

- Convert their contract into an employment agreement.

- Register them with EOBI and provincial Social Security.

- Add them to Remire’s Employer of Record (EOR) system — where Remire legally employs them on your behalf while you manage their daily work.

How Contractors in Pakistan Get Paid?

Remote contractors working for foreign clients, especially US-based companies, are usually paid in USD through international transfers or global payment platforms. Common options include:

- Wise (formerly TransferWise): Transparent FX rates and direct deposit to Pakistani bank accounts.

- Payoneer: Widely used by freelancers; allows USD collection and local PKR withdrawal.

- Remitly / Western Union: For ad-hoc payments or smaller projects.

- SWIFT wire transfers: Suitable for larger retainers or company-to-company contracts (though slower and costlier).

U.S. Tax Implications for Hiring Pakistani Contractors

For U.S.-based companies:

- Payments to Pakistani contractors are considered foreign-sourced income, so U.S. withholding tax does not apply.

- You must collect a Form W-8BEN from each contractor to confirm their foreign tax status.

- The contractor is not issued Form 1099-NEC since they are not a U.S. tax resident.

- The expense can be recorded as a business deduction if you maintain invoices, contracts, and payment records.

Terminating Independent Contractors in Pakistan

Ending a contract with a contractor in Pakistan is simple if you follow the right steps.

- Always have a written contract that clearly says how and when the agreement can end.

- Give proper notice before ending the contract — usually 7 to 30 days.

- Pay any pending invoices or project fees before closing the contract.

- Keep email records and documents to avoid future disputes.

Remember, contractors are not employees, so benefits like severance or EOBI do not apply.

Frequently Asked Questions

Can a US company hire an international contractor?

Yes. A US company can legally hire international contractors without opening a foreign office. It just needs a proper independent contractor agreement, Form W-8BEN, and a secure international payment setup for tax compliance.

Can I work remotely for a US company from Pakistan?

Yes. Many professionals in Pakistan work remotely for US companies as independent contractors. You’ll need a valid service contract, a way to receive USD payments (e.g., Wise or Payoneer), and to file your income tax with Pakistan’s FBR.

Wrapping Up

If your company is ready to scale globally and wants to hire contractors in Pakistan for US-based companies, our team at Remire can help you.

We streamline contract drafting, payment processing, tax compliance, and remote-team management.

Contact us today to get started and tap into Pakistan’s skilled remote workforce with confidence.