Empleador de registro

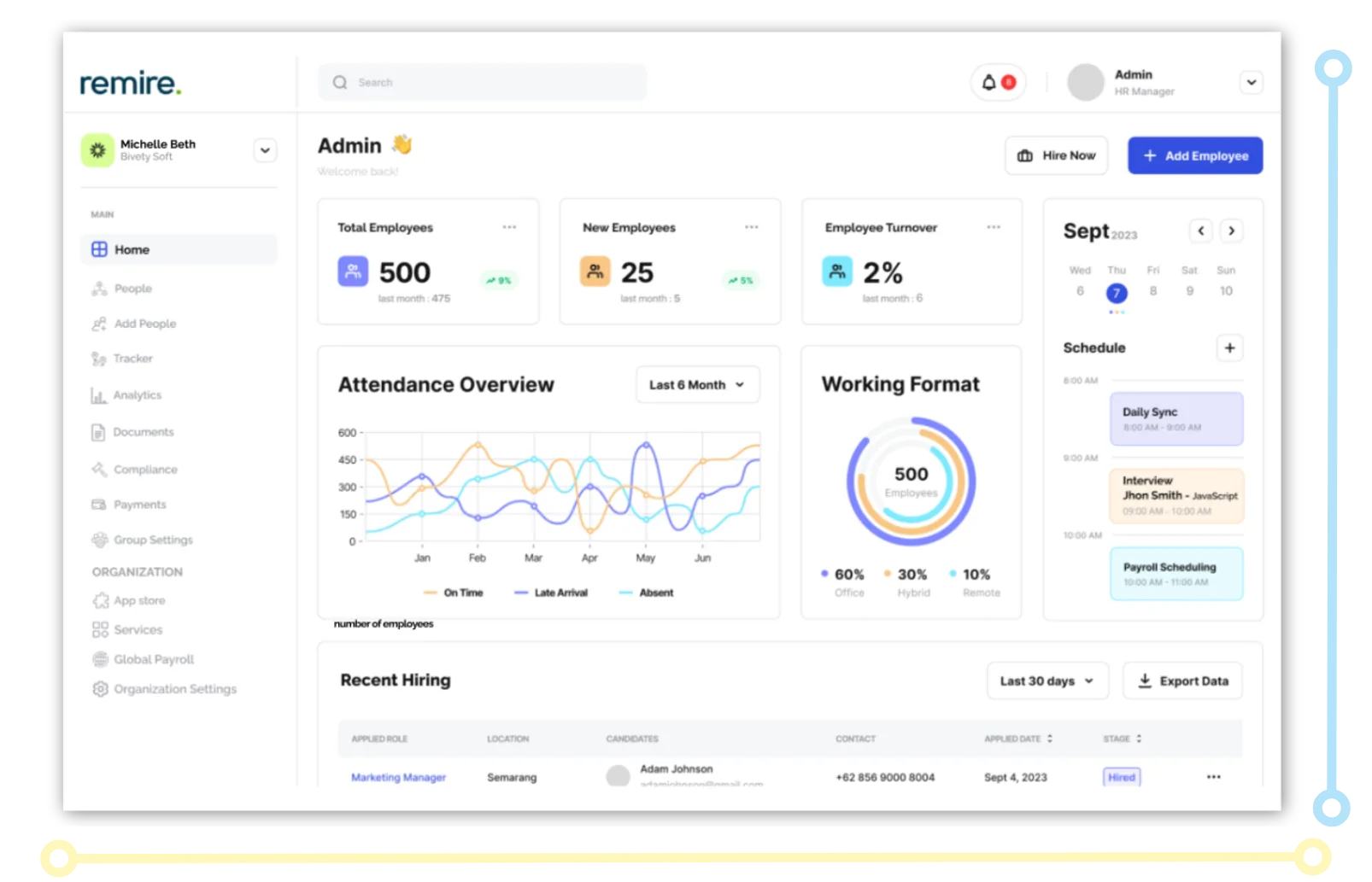

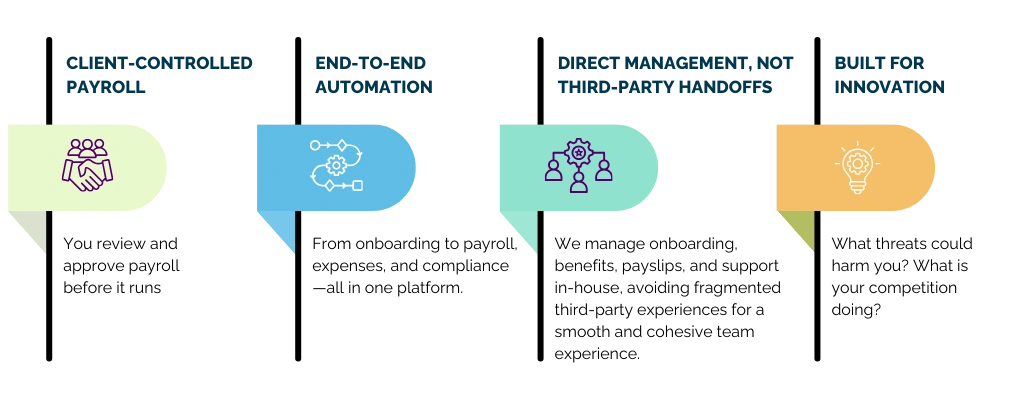

Business Model

Onboarding

Onboarding employees in various countries involves distinct processes and requirements. That’s why we tailor each aspect for you, from adhering to local labor laws to managing country-specific paperwork—ensuring you can onboard employees quickly and compliantly.

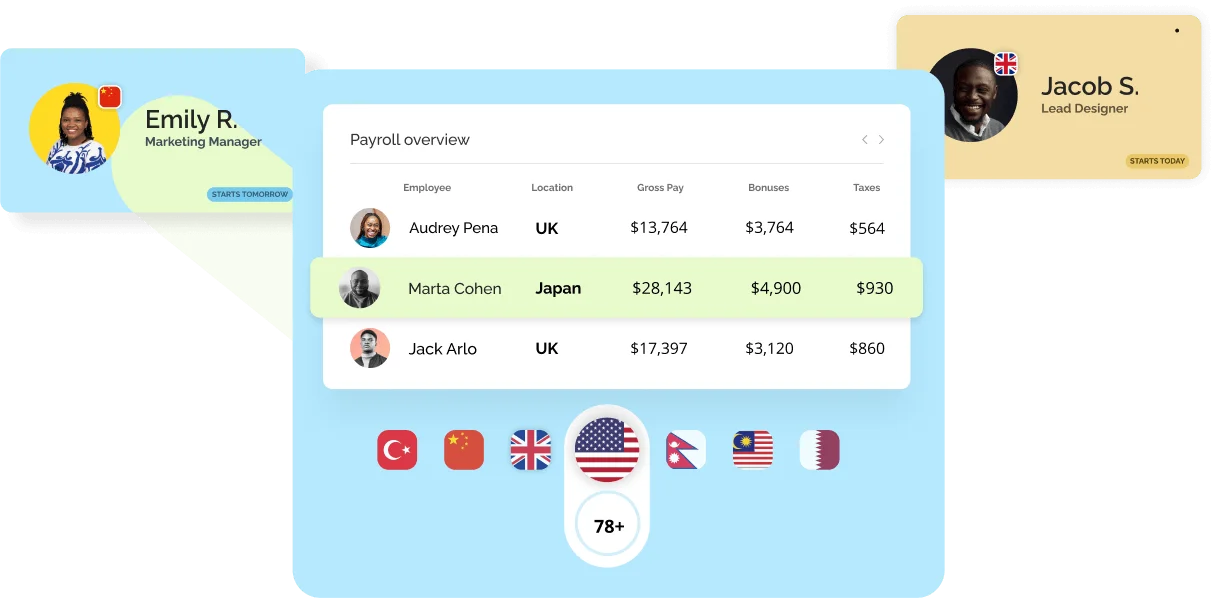

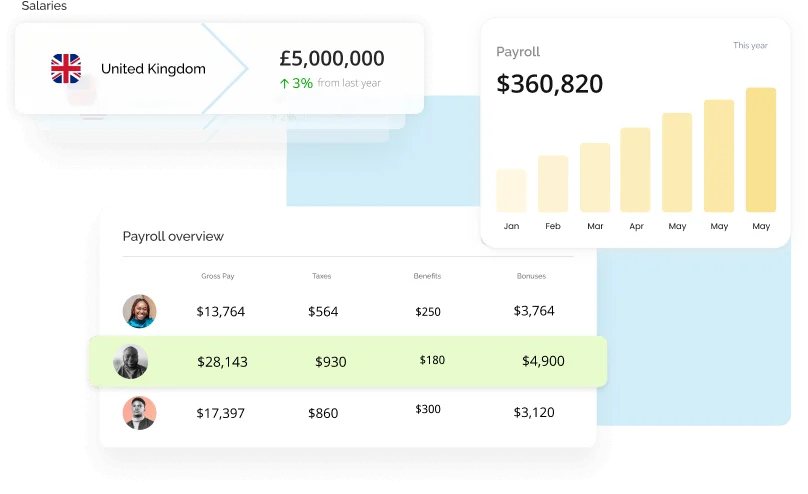

Payroll

Approve expenses and bonuses seamlessly while our dedicated payroll team does all the meticulous work from managing local taxes to handling withholdings, deductions, and benefits across multiple countries.

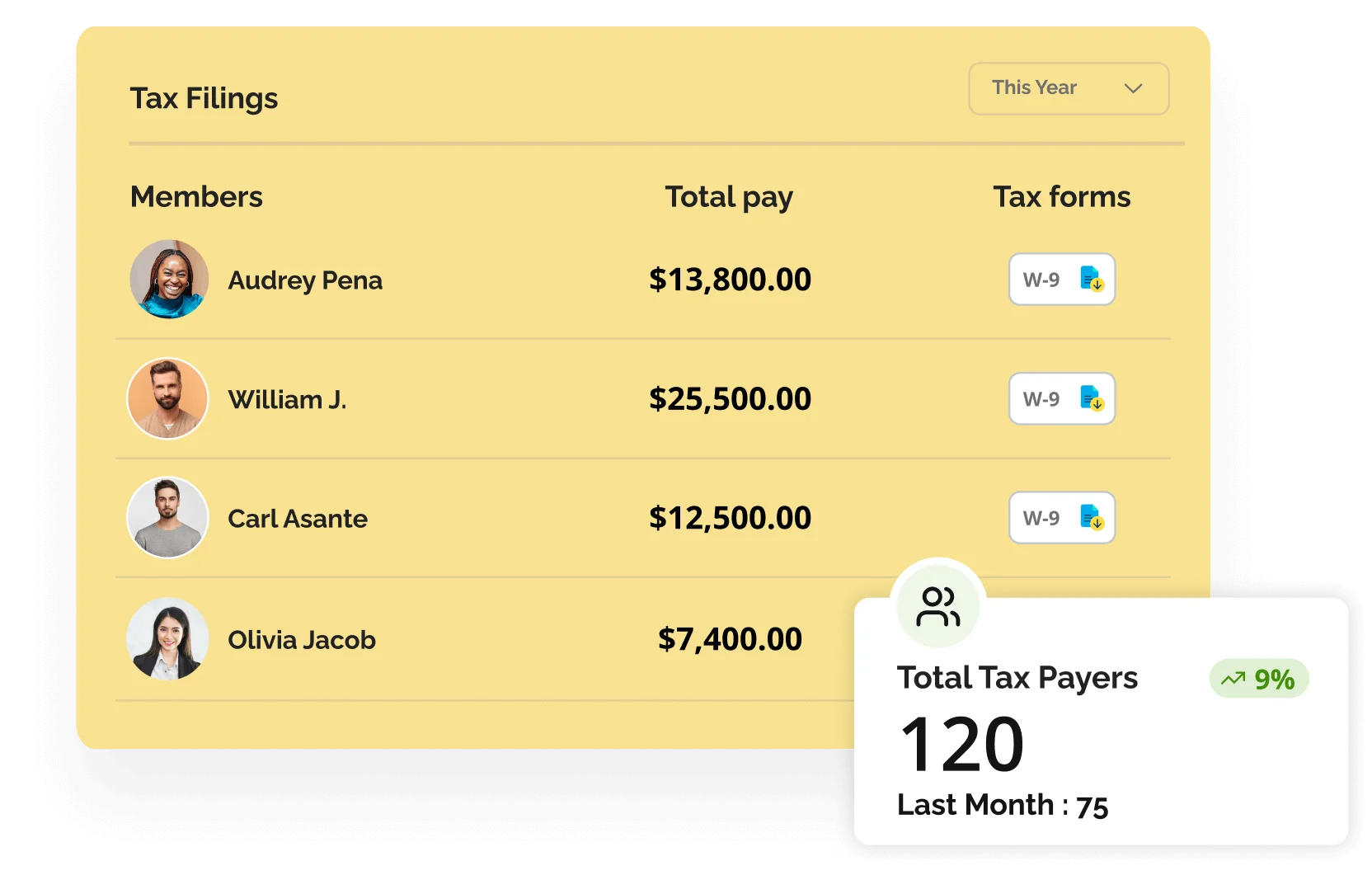

Tax Filings and Compliance

As your EOR partner, we handle all tax filings and compliance, managing the complexities of local regulations and legal requirements for you. Our specialized team ensures that every aspect, from tax deductions to statutory filings, is carefully addressed in accordance with each country’s laws.

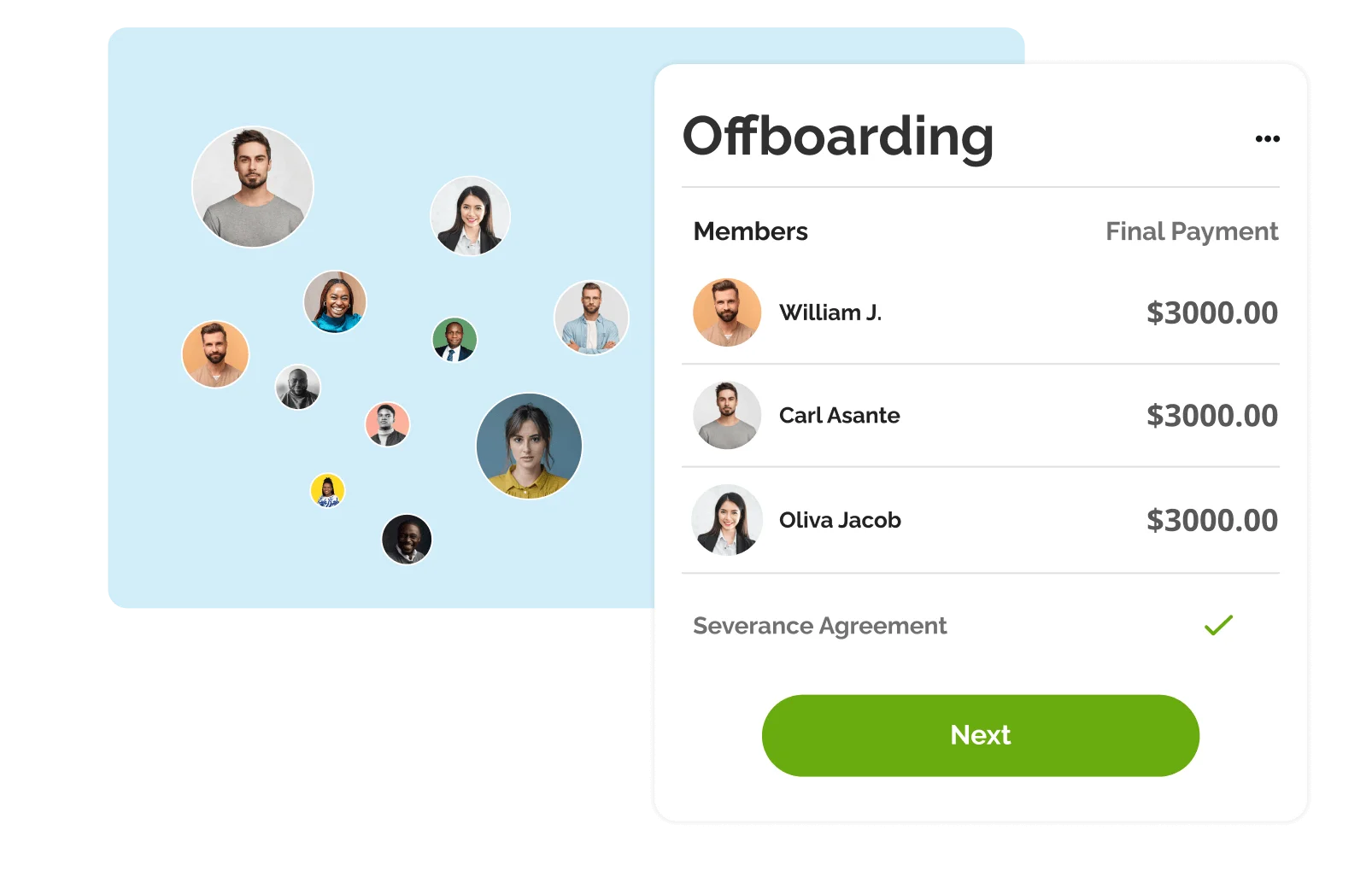

Offboarding

Minimize risks to your organization during the offboarding process. Allow Remire to accurately compute the final payment based on the termination date, applicable country labor laws, used vacation days, and other relevant factors, ensuring a smooth and compliant transition.

Employment Contracts & Benefits

We take care of employment contracts and benefits for your team. From creating clear contracts to managing perks, we make sure everything is fair and follows the rules.

Termination & Legal Risks

We guide you through the process of ending employment while reducing legal risks. Our support helps you stay compliant with labor laws and ensures a smooth and respectful offboarding.