Hiring remote talent in Asia has become a smart move for U.S. companies looking to access specialized skills, improve coverage across time zones, and optimize costs. But while the benefits are clear, the legal path is not always straightforward. Each country has its own labor laws, tax rules, and compliance standards, making it risky to hire without proper structure. From misclassification issues to unexpected liabilities, one wrong step can cost more than you save.

To understand how to do it right, let’s first explore why Asia has become such a hotspot for U.S. companies building remote teams.

Why U.S. Companies Are Looking to Asia for Remote Talent

Asia has become a global talent magnet, offering a combination of scale, specialization, and cost-effectiveness that’s hard to ignore. For U.S. companies, it’s not just about saving money, it’s about finding the right skills at the right time.

Skilled and Specialized Workforce

Countries like India, the Philippines, Vietnam, and Pakistan offer deep talent pools in software development, data science, design, customer support, and more. Universities across the region are producing highly trained graduates in STEM and business fields. Many professionals also have experience working with Western companies, bringing strong English communication and cultural adaptability.

Cost Advantages Without Quality Trade-Offs

Labor costs in Asia are significantly lower than in the U.S., but the quality of work, especially in tech and service roles remains globally competitive. For startups and mid-sized companies, this creates a huge opportunity to scale operations without burning through budget. The savings go beyond salaries and extend into benefits, office space, and training.

Time Zone Coverage

Remote teams in Asia allow U.S. companies to maintain near 24/7 operations, especially valuable for support, infrastructure, and DevOps teams. Teams can pass off work across time zones, speeding up project delivery and customer response times. This “follow-the-sun” model is now a key driver of global productivity.

Remote-Readiness

The remote work culture is thriving in Asia. Many professionals already operate in distributed teams and are equipped for global collaboration. With high-speed internet access, established freelance ecosystems, and digital-first mindsets, many Asian professionals are already used to remote workflows and async communication tools.

Legal Considerations for Hiring in Asia

Hiring remote talent across Asia isn’t just a plug-and-play process. Every country comes with its own set of labor laws, tax frameworks, and employment classifications. Failing to address these early on can lead to fines, back pay claims, or reputational risks.

Employee vs. Contractor Classification

Misclassifying an employee as a contractor is one of the most common—and costly—mistakes. Countries like India and the Philippines have strict definitions of what constitutes an employee, including control over work hours, tools, and deliverables. Getting this wrong can trigger penalties, retroactive taxes, and forced employee benefits.

Country-Specific Labor Laws

Labor protections vary widely. For example, Vietnam requires mandatory written contracts and minimum notice periods for termination, while India mandates contributions to government-run social schemes. U.S. companies must adapt to each country’s rules or risk non-compliance and litigation.

Tax Compliance and Withholding Obligations

Many countries require employers to withhold income tax and contribute to social security or pension funds. Without a legal entity, managing this becomes complex and risky. In some cases, the remote worker could be classified as self-employed but still trigger permanent establishment concerns for the U.S. company.

Data Protection and IP Ownership

Safeguarding intellectual property is essential when working with international remote teams. Countries like Singapore have robust data protection laws, while others may require additional clauses to ensure IP rights transfer legally to the employer. Contracts must reflect not just confidentiality, but ownership and jurisdiction over deliverables.

Hiring Methods Available to U.S. Companies

Once a U.S. company decides to hire remote employees in Asia, the next step is choosing the right method to do so legally. Each option comes with its own pros, cons, and levels of responsibility. Here are some of the options:

Direct Hiring Through a Local Entity

Setting up a legal entity in the target country gives full control over employment but also comes with administrative burdens. You’ll need to register with tax authorities, comply with labor laws, and manage ongoing filings and audits. This route is viable for companies planning long-term operations in one country, but it’s resource-heavy for small teams or early-stage expansion.

Engaging Independent Contractors

Hiring contractors may seem simple, but it carries significant legal risk. If local authorities determine the contractor is functioning like an employee, working fixed hours, reporting to a manager, or using company systems, your company could face misclassification penalties. This model offers flexibility but lacks legal protection for both the company and the worker.

Using a Local Agency or Staffing Firm

Some U.S. companies partner with local recruiting firms to source and manage workers. While this can help navigate local hiring, you still bear responsibility for legal compliance, especially if the agency doesn’t handle contracts or payroll. Additionally, communication gaps and inconsistent standards can create long-term friction.

Working with an Employer of Record (EOR)

This is the most efficient and legally sound method for U.S. companies hiring abroad without setting up an entity. An EOR becomes the legal employer in the employee’s country, handling contracts, payroll, tax, and compliance. Your company directs day-to-day work, while the EOR takes on all legal risk and backend responsibility.

Why EOR Is the Most Reliable Path for Legal Compliance

For U.S. companies that want to hire in Asia without the complications of entity setup or compliance risks, an Employer of Record (EOR) is the smartest path forward. It offers a clean, legal framework that makes international hiring faster, safer, and far more scalable.

Full Legal Employment Without a Local Entity

The EOR becomes the official employer on paper, while you manage the employee’s day-to-day work. This means the EOR handles contracts, social security registration, tax deductions, and labor law compliance, all without your company needing to register locally.

Misclassification Risk Eliminated

Instead of navigating the gray areas with contractors, an EOR ensures that each hire is fully compliant with local employee classification rules. This helps avoid government penalties, retroactive tax obligations, and legal disputes with workers down the line.

Payroll, Taxes, and Benefits Handled

The EOR processes payroll in the local currency, handles mandatory benefits, and makes all tax filings. They also manage perks like paid time off, bonuses, and insurance, everything aligned with the host country’s legal standards.

Faster Hiring, Lower Costs

With an EOR, onboarding can take days—not months. You skip the paperwork, lawyers, and consultants needed for an entity setup. It’s ideal for pilot projects, small teams, or fast-growing companies testing new markets.

Built-In Compliance Infrastructure

EORs are designed to stay updated on local employment laws, so you don’t have to. From contract language to statutory leave updates, they ensure everything stays compliant, even as regulations evolve.

How Remire Supports U.S. Companies Hiring in Asia

At Remire, we’ve built our platform around one goal: making global hiring easier, safer, and faster for companies expanding beyond borders. For U.S. businesses looking to tap into Asia’s talent pool, we take on the operational weight, so you can focus on building your team.

- Legal Employment Setup Without the Complexity: Remire acts as the legal employer on your behalf in multiple Asian countries. We handle contracts, register with local authorities, and manage employment in full alignment with local labor laws.

- Localized Payroll and Benefits: We run payroll in local currency, file required taxes, and offer benefits tailored to market standards, from paid leave and health coverage to statutory bonuses. Your remote hires are paid accurately, on time, and compliantly.

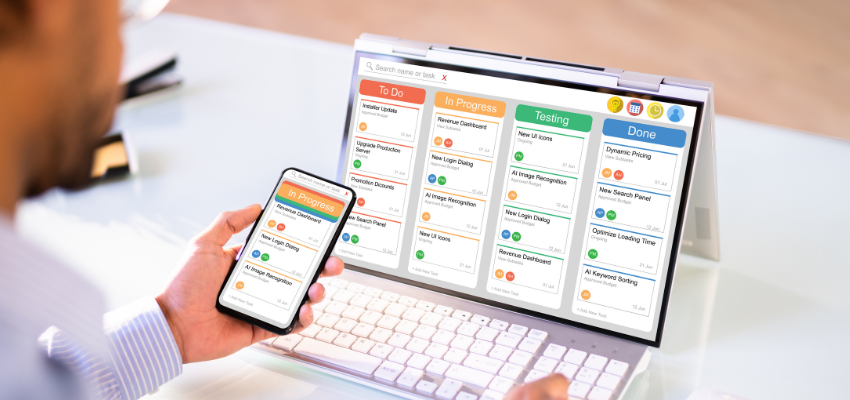

- One Platform, Full Visibility: Our centralized dashboard gives your team real-time access to payroll reports, contract documents, and workforce analytics across every country you operate in.

- Expert Support, Human Touch: With a dedicated account manager and in-country experts, you get personalized guidance through every step. From onboarding to exit formalities, Remire ensures every hire is managed with care and clarity.

- Flexibility for Growth: Whether you’re hiring one developer in Vietnam or building a support team in the Philippines, Remire scales with you, without requiring a local entity or a legal team in every region.

With Remire, hiring in Asia isn’t just possible, it’s practical, compliant, and built for growth.

Key Mistakes to Avoid When Hiring Remotely in Asia

Hiring remotely in Asia offers major advantages, but if done wrong, it can backfire fast. Here are the most common mistakes U.S. companies make when expanding their teams abroad:

Misclassifying Employees as Contractors

Many companies default to contractor agreements to bypass legal setup—but this often violates local laws. Misclassification can lead to fines, back pay, and employee-triggered legal action. Some countries conduct routine audits on contractor arrangements and reclassification can trigger retroactive obligations. A full-time worker labeled as a contractor may also lose access to statutory benefits, which reflects poorly on your company’s reputation.

Ignoring Country-Specific Tax and Labor Rules

What’s legal in one Asian country might be illegal in another. From mandatory benefits to notice periods and tax deductions, non-compliance—even unintentional—can cause reputational damage and financial penalties. For example, failing to provide a 13th-month salary in the Philippines or social security in India is a breach of law. These gaps also create friction with employees who expect legal protections and stability.

Using U.S. Employment Contracts Abroad

Reusing a U.S. offer letter in India or Vietnam won’t cut it. Employment terms must be localized to reflect legal obligations and cultural expectations, or you risk breaching local law. Most countries require contracts to be written in the native language or include local clauses like termination conditions, probation terms, and severance. A U.S.-centric contract also sends the wrong message to your international hires that their local needs aren’t being considered.

Delaying Payments or Using the Wrong Currency

Paying in USD when local law requires local currency? That’s a compliance issue. Delays, incorrect withholdings, or missed bonuses erode trust and invite scrutiny. Many countries enforce strict rules around payment timelines and currency declarations. Employees expect reliability, and inconsistencies in payroll are a quick way to lose them.

Underestimating Communication & Cultural Fit

Hiring remotely isn’t just about skills, it’s about integration. Ignoring time zones, work styles, or language nuances can lead to misalignment, high churn, or failed projects.

Poor onboarding and unclear expectations can derail even the most talented hires. Successful remote teams prioritize relationship-building, async communication, and cultural awareness from day one.

Hiring Remotely in Asia, Done Right

Building remote teams in Asia opens the door to top talent and serious cost advantages, but only if done compliantly. From payroll and contracts to cultural expectations and legal nuances, every step matters. The companies that get it right aren’t guessing, they’re partnering with experts who know the terrain. That’s where working with the right EOR makes a real difference.

Remire helps U.S. companies navigate hiring in Asia with zero red tape, zero missteps, and complete compliance. If you’re ready to expand globally without the legal headaches, we’re here to make it happen.

Faqs

Are remote tech teams available in Pakistan?

Yes, Pakistan has a large and growing pool of skilled remote tech talent available across various domains, including software development, DevOps, and data engineering.

What is the employer of record in Pakistan?

An Employer of Record in Pakistan is a third-party entity that legally employs workers on your behalf, handling compliance, payroll, and local labor laws while you manage daily tasks.

What are the rules for hiring employees from Pakistan?

Employers must comply with local labor laws, including formal contracts, tax registration, social security contributions, and statutory benefits like paid leave and bonuses.

What are the employment and labor laws in Pakistan?

Pakistan’s labor laws cover minimum wage, working hours, overtime, termination procedures, employee benefits, and social security contributions, with variations across provinces.