Expanding your business to Australia has never been easier. With Remire’s Employer of Record (EOR) services in Australia, you can hire, pay, and manage top Australian talent without the cost or complexity of setting up a local entity.

Whether you’re hiring remote developers, customer success agents, or sales teams, Remire ensures full compliance with Australian labor laws, tax regulations, and Fair Work standards, so you can scale confidently.

What Is an Employer of Record (EOR) in Australia?

An Employer of Record (EOR) is a third-party organization that legally employs workers on your behalf. While your company manages the employee’s daily work, the EOR handles all local HR, payroll, tax, and compliance responsibilities.

How an EOR Helps You Hire Without an Entity

- No need to register a business or subsidiary in Australia.

- The EOR manages payroll, superannuation, and local taxes.

- You stay focused on your core operations while remaining 100% compliant.

Legal Framework for EOR in Australia

Remire operates under Australia’s Fair Work Act 2009, ensuring all contracts meet local employment standards, minimum wages, and superannuation obligations.

5 Key Employment Regulations in Australia Your EOR Will Handle

Hiring in Australia means navigating one of the world’s most employee-protective labor systems. Remire manages the details, ensuring your operations stay compliant.

1. Fair Work Act & National Employment Standards (NES)

The NES guarantees fair working hours, paid leave, and notice periods. We make sure every employment contract meets these standards so your employees are protected and your business stays compliant.

2. Superannuation Compliance

Employers must contribute a set percentage of salaries to employee retirement funds. Remire calculates and submits these contributions accurately and on time, avoiding costly penalties.

3. Leave Entitlements

Employees are entitled to paid annual, personal, and parental leave. We manage accruals, track balances, and ensure compliance with national award conditions.

4. Tax Withholding & Reporting

Our team handles all PAYG tax deductions and reporting to the ATO, ensuring every payslip meets Australian standards.

5. Termination & Severance Rules

Australia has strict termination procedures. We manage compliant offboarding to protect you from unfair dismissal claims or legal disputes.

Why Use EOR Services in Australia? Key Benefits

Hiring employees through an EOR offers flexibility, speed, and risk-free expansion.

Hire Australian Talent Quickly and Compliantly

Start onboarding employees in days — not months — with Remire handling every legal and administrative step.

Save Time and Cost

Avoid high setup and operational costs associated with registering a local company.

Simplify Payroll and Benefits

We handle payroll in AUD, tax deductions, leave management, and employee benefits like superannuation and annual leave entitlements.

Key Employer of Record (EOR) Services We Offer

Payroll Management and Tax Compliance

Accurate and timely salary processing, PAYG withholding, and superannuation contributions — all managed by local experts.

Employment Contracts and HR Support

We draft compliant employment agreements, handle onboarding, and maintain records per Fair Work Australia standards.

Benefits and Leave Administration

Full management of health coverage, leave tracking, and entitlements in line with Australian workplace awards.

Work Permits and Onboarding for Expats

Smooth visa sponsorship and relocation support for international staff joining Australian teams.

When Should You Consider Using an EOR in Australia

EOR isn’t for everyone — but in the right situations, it’s a game-changer.

You Don’t Have a Local Entity

If you want to hire in Australia but lack a registered company, an EOR lets you employ legally without delay.

You’re Hiring Remote or Individual Workers

Support Australian-based talent under full compliance, even if your company isn’t locally incorporated.

You’re Testing the Market

Use an EOR to build a small local team and test opportunities before committing to permanent expansion.

You Need to Onboard Quickly

Speed is critical — we onboard employees within days, not months.

You Want to Avoid Legal Risks

Employment laws are strict. An EOR shields you from errors like misclassification or underpayment penalties.

How the EOR Model Works in Australia

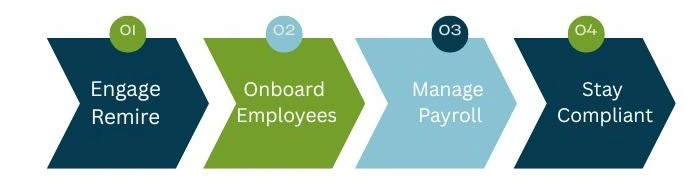

Step-by-Step Hiring Process

- Engage Remire: Share your hiring needs.

- Onboard Employees: We prepare compliant contracts.

- Manage Payroll: Remire administers monthly salaries, benefits, and taxes.

- Stay Compliant: Continuous HR and legal compliance monitoring.Key Employer of Record (EOR) Services We Offer

EOR vs. Client Responsibilities in Australia

| Task | Employer (You) | Remire (EOR) |

|---|---|---|

| Work supervision |

|

|

| Payroll & taxes |

|

|

| Employment contracts |

|

|

| Compliance & reporting |

|

EOR vs PEO in Australia: What’s the Difference?

Both EOR and PEO simplify hiring, but the key difference is ownership of employment responsibility.

| Feature | EOR | PEO |

|---|---|---|

| Legal Employer | EOR (Yes) | Shared (No) |

| Entity Required | NO |

|

| Ideal for | Global expansion | Local teams |

| Compliance Risk | Minimal | Shared |

In short, if you don’t have an entity in Australia, an EOR is the only fully compliant option.

EOR vs Setting Up a Local Entity in Australia

| Criteria | EOR | Entity Setup |

|---|---|---|

| Setup time | 2–5 days | 3–6 months |

| Cost | Low | High |

| Compliance burden | Minimal | Heavy |

| Scalability | Easy | Limited |

EOR is faster, cheaper, and less risky, especially for startups or global companies testing the Australian market.

Why Choose Remire as Your EOR Partner in Australia

- Local legal and HR expertise — deep understanding of Fair Work laws and superannuation.

- Seamless onboarding and payroll platform — manage global hires from one dashboard.

- Transparent pricing and compliance reporting.

- Dedicated support for both employers and employees.

We’ve helped global teams across tech, SaaS, finance, and logistics scale into Australia — efficiently and compliantly.

Hire Through Remire’s EOR Platform: 3-Step Process

- Tell us who you want to hire.

- We onboard them legally in Australia.

- You manage their work; we handle the rest.

Ready to expand your team to Australia without the red tape?

FAQs about EOR in Australia

Is Employer of Record legal in Australia?

Yes. EOR services are fully legal in Australia when operated under the Fair Work Act 2009, ensuring compliance with employment, tax, and superannuation laws.

How much does EOR charge?

EOR pricing in Australia typically ranges from USD 200–600 per employee per month, depending on services like payroll, benefits, and visa support.

How do I find a company willing to sponsor my visa in Australia?

Look for employers or EOR providers registered as Standard Business Sponsors with the Australian Department of Home Affairs. They can legally sponsor foreign workers under visa categories like TSS 482.

What is EOR in immigration?

In immigration, an Employer of Record (EOR) acts as the legal employer for visa sponsorship and compliance — managing contracts, payroll, and visa obligations on behalf of the client company.

Ready to Hire in Australia the Right Way?

Hiring in Australia is full of opportunities, but also complex rules. Remire’s Employer of Record (EOR) makes it simple. We handle compliance, payroll, and contracts so you can hire fast and stay risk-free.

Hire confidently. Expand effortlessly.